Freecharge Company : An Overview of the Popular Indian Digital Payments Company

In recent years, the use of digital payments has seen an exponential increase in India, with companies like Paytm, PhonePe, and Freecharge leading the charge. Among these companies, Freecharge has emerged as one of the most popular and trusted names in the Indian digital payments space. In this article, we will take a closer look at Freecharge, its history, features, and impact on the Indian digital payments landscape.

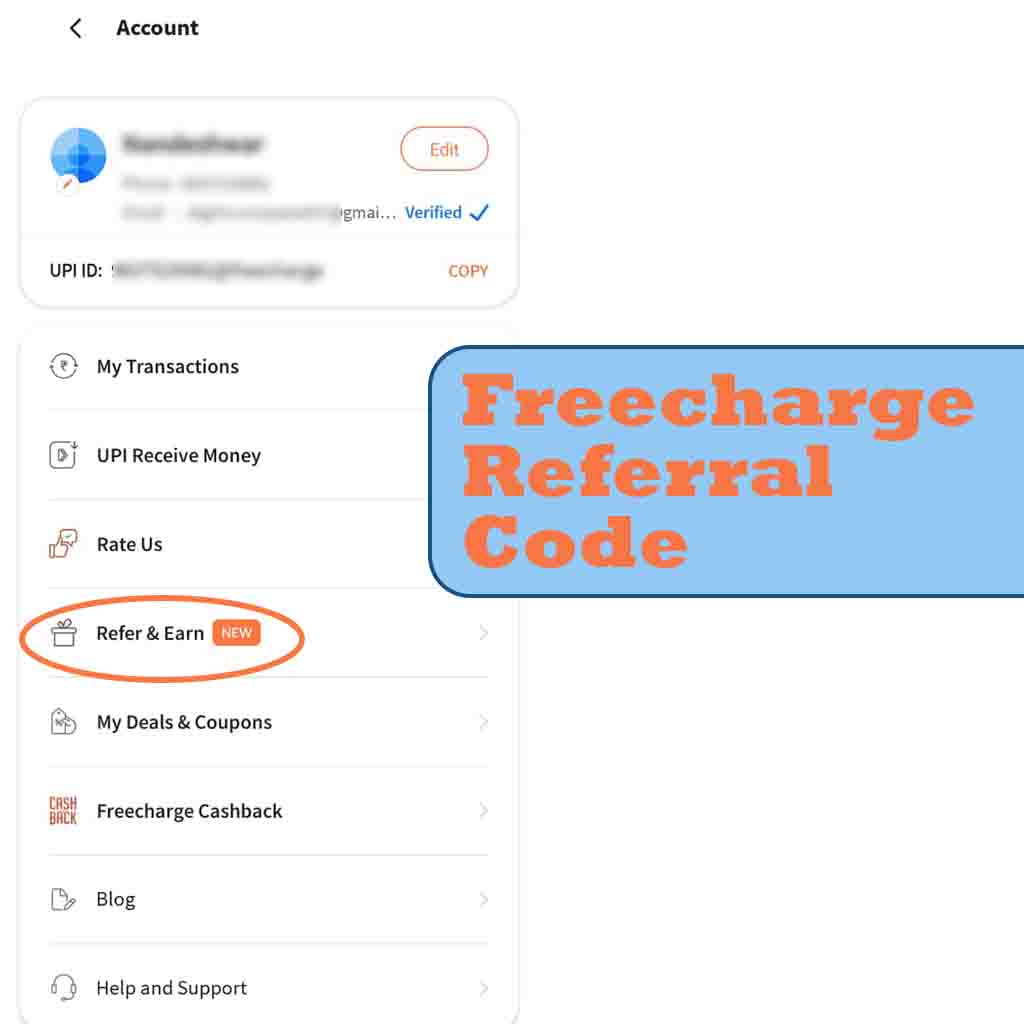

Freecharge Referral Code : 60NcEh

Freecharge Referral Link : Download Now

History of Freecharge

Freecharge Company was founded in August 2010 by Kunal Shah and Sandeep Tandon. Initially, the company started as a mobile recharge and bill payment platform but later expanded its services to include other digital payment options like wallet payments, UPI payments, and QR code payments. In 2015, Freecharge was acquired by the Indian e-commerce giant, Snapdeal, for a reported $400 million. However, in 2018, the company was sold to Axis Bank for $60 million.

Features of Freecharge

Freecharge offers a wide range of digital payment options to its users, making it a popular choice among Indian consumers. Some of the key features of Freecharge include:

- Mobile Recharge and Bill Payments: Users can easily recharge their mobile phones and pay their utility bills, including electricity, gas, and water bills, using Freecharge.

- Wallet Payments: Freecharge users can also use the wallet feature to store money and make quick and easy payments for a range of services, including cab rides, movie tickets, and online shopping.

- UPI Payments: Freecharge also offers UPI payments, which allow users to transfer money directly from their bank account to another user’s account in real-time.

- QR Code Payments: Users can make payments by simply scanning QR codes using the Freecharge app. This feature is particularly useful for small businesses and street vendors who do not have the infrastructure to accept digital payments.

Impact of Freecharge

Freecharge has played a significant role in the growth of digital payments in India. The company’s user-friendly app and extensive range of payment options have made it easier for consumers to switch to digital payments. Moreover, the company’s focus on security and customer satisfaction has helped build trust among its users.

Freecharge has also helped small businesses and street vendors to adopt digital payments, which has resulted in a significant increase in the number of digital transactions in India. According to a report by the National Payments Corporation of India (NPCI), the total number of UPI transactions in India grew from 2.06 billion in April 2020 to 2.73 billion in May 2020, a growth of over 30%. This growth can be attributed in part to the increasing popularity of digital payment platforms like Freecharge.

Related Articles

Conclusion

Freecharge Company has emerged as one of the leading digital payment platforms in India, thanks to its user-friendly app, extensive range of payment options, and focus on security and customer satisfaction. The company has played a significant role in driving the growth of digital payments in India, particularly among small businesses and street vendors. With the increasing adoption of digital payments in India, Freecharge is likely to continue to play an important role in the Indian digital payments landscape.